Best Fintech Apps – Downloads & Investments

Europe’s fintech unicorns see an increase of 33% downloads in 2021.

Here at App Radar, we like to dig deeper into interpreting what the data actually means. So we looked at the fintech app companies which achieved unicorn status in 2021 and their amount of Android app downloads. How many downloads have they received next to their high investments? Then we compared it with the fintech apps that are currently trending with the highest amount of downloads in general on the Google Play Store.

These two variables together give a good overview of who is winning in the fintech industry – either by the traction they’re receiving from users or investors.

Best Fintech Apps with Unicorn Status 2021

Finance continues to be one of the leading app categories among European unicorns. And fintech also continues to be one of the main sectors in European funding. By June 2021, Europe had already raised €10.4bn, breaking the previous record of €9.3bn set in 2019.

In 2020, fintech startups received from venture capital investors $44.1 billion. In 2009 it was only $1.1 billion.

What is an “unicorn” among fintech apps?

Just like in fairy tales, unicorns in the business world refer to something magical as well. It is a privately held company that reaches the rare status of being valued over $1 billion. Variants include also a decacorn, valued at over $10 billion, and a hectocorn, valued at over $100 billion.

Some unicorns are rather unknown companies quietly having a high impact on their industry. Others are well-branded industry leaders, like aerospace manufacturer SpaceX and game developer/publisher Epic Games.

BitPanda leads with the growth among fintech apps

We looked at 14 fintech app companies that announced unicorn status in 2021, to determine how downloads performance on the Google Play store compared to the previous year and how much bearing downloads had on valuation. There were in total 8.6 million Android downloads while they achieved unicorn status. That’s a 33% increase (until the end of November) in the number of app downloads compared to during 2020.

BitPanda saw the biggest percentage increase in its download numbers in 2021, from 132K to 754K, an increase of almost 470%. Following were Trade Republic (150% with 1.3M new users) and Swile (94% with 156K new users).

Marshmallow and Pleo had the smallest customer base on achieving unicorn status with just 19K and 35K total Android downloads respectively. Blockchain.com had the largest number of downloads when they unicorned, at 10.2 million.

| Company | Date of unicorn announcement | Google Play downloads when unicorned |

|---|---|---|

| Marshmallow Insurance | 8 September 2021 | 19K |

| Zilch | 10 November 2021 | 210K |

| Bitpanda | 16 March 2021 | 491K |

| Trade Republic | 20 May 2021 | 1.1M |

| Swile | 11 October 2021 | 256K |

| Zopa | 19 October 2021 | 197K |

| Alan | 19 April 2021 | 55K |

| Pleo | 6 July 2021 | 35K |

| Scalable Capital | 8 June 2021 | 763K |

| Lunar | 12 July 2021 | 486K |

| Zego | 9 March 2021 | 179K |

| Blockchain.com | 17 February 2021 | 10.2M |

| Starling Bank | 8 March 2021 | 1.9M |

| ZEPZ | 23 August 2021 | 5.6M |

Two of the apps also made their debut on the Google Play store, including Marshmallow Insurance, gaining 34K downloads, and Zilch which gained 232K.

When you look at the customer base of each 2021 fintech unicorn you can see how much higher the bar is for consumer facing apps versus ones that predominantly cater to businesses. In most cases, you need around 1 million downloads on Android which would likely translate into at least 2 million users when you include other platforms. However, for most B2B apps low hundreds of thousands, and in some cases even tens of thousands seem to be more than enough for the market at the moment.

– Thomas Kriebernegg, MD of App Radar

| Company | Date unicorn announcement | Downloads in 2021 | Downloads in 2020 |

|---|---|---|---|

| Alan | 19 April 2021 | 44K | 25K |

| Bitpanda | 16 March 2021 | 754K | 132K |

| Blockchain.com | 17 February 2021 | 3.1M | 2.7M |

| Lunar | 12 July 2021 | 211K | 176K |

| Marshmallow Insurance | 8 September 2021 | 34K | N/A |

| Pleo | 6 July 2021 | 22K | 12K |

| Scalable Capital | 8 June 2021 | 558K | 356K |

| Starling Bank | 8 March 2021 | 578K | 642K |

| Swile | 11 October 2021 | 156K | 80K |

| Trade Republic | 20 May 2021 | 1.3M | 544K |

| Zego | 9 March 2021 | 98K | 83K |

| ZEPZ (WorldRemit) | 23 August 2021 | 1.3M | 1.5M |

| Zilch | 10 November 2021 | 232K | N/A |

| Zopa | 19 October 2021 | 122K | 66K |

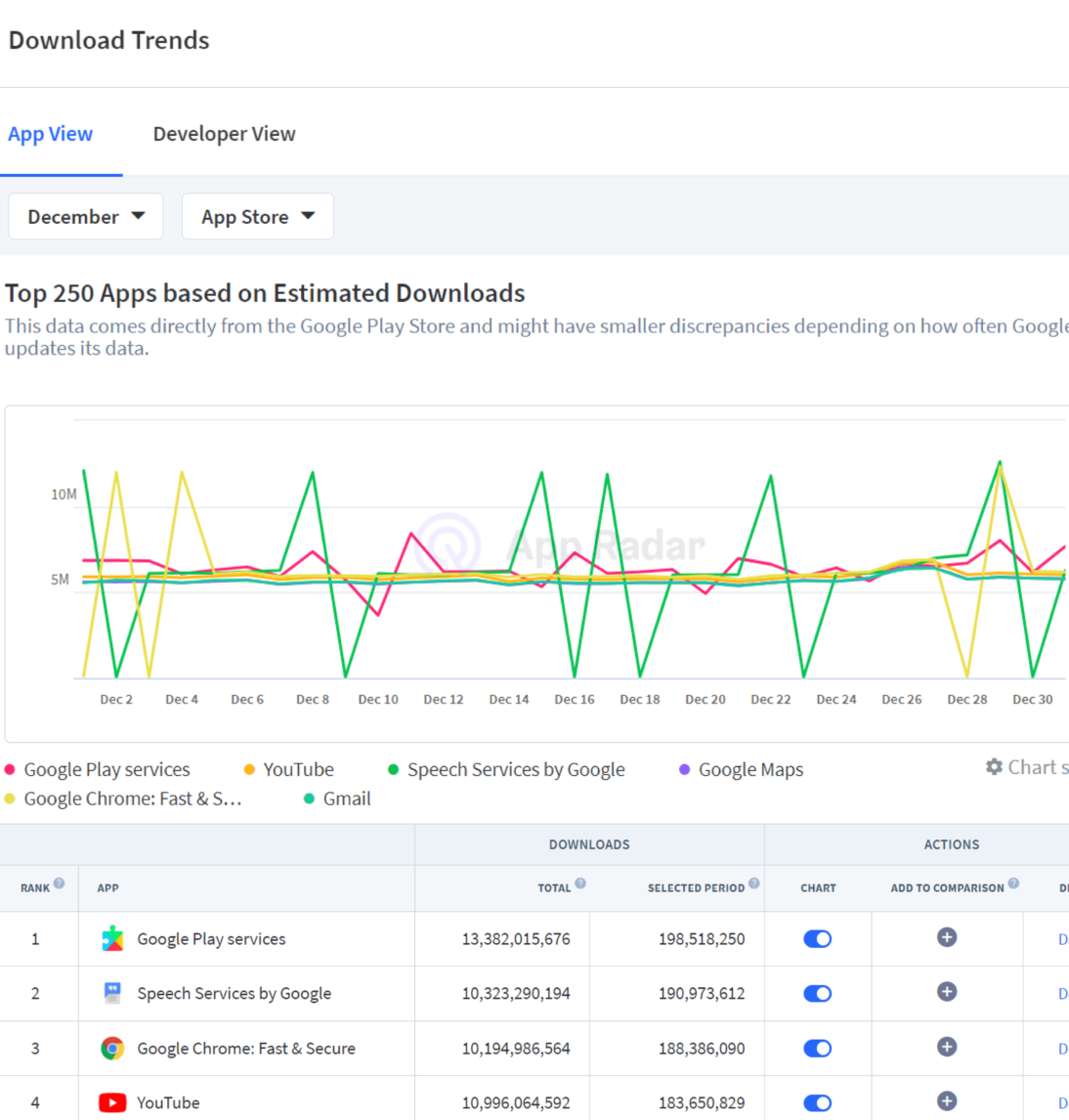

Best Fintech Apps by Worldwide Android Downloads

Besides looking at the highest evaluations of fintech companies with apps, we also gathered data about the ones currently getting the most downloads on the Google Play Store in general. In other words, to define the best fintech apps, below is a list of Google Play Top 50 for finance category, based on the number of downloads in December 2021.

Note: you can check out this data under Market Analytics in App Radar for all Google Play categories on a monthly basis and access also historical data.

50 Most Downloaded Fintech Apps on Google Play

For the selected period, the most popular apps for the finance category on Google Play were for mobile payments, crypto platforms and challenger banks. Such as Google Pay, PayPal, Binance, Nubank and Crypto.com.

| Rank | App | Estimated Google Play Downloads in December 2021 |

|---|---|---|

| 1 | Google Pay | 19.8M |

| 2 | Google Pay | 15.3M |

| 3 | PhonePe: UPI, Recharge, Investment, Insurance | 9.1M |

| 4 | Paytm -UPI, Money Transfer, Recharge, Bill Payment | 6.4M |

| 5 | PayPal - Send, Shop, Manage | 5.3M |

| 6 | Binance: BTC NFTs Memes & Meta | 3.3M |

| 7 | Nubank: conta, cartão e mais | 3.1M |

| 8 | YONO SBI: Banking & Lifestyle | 2.6M |

| 9 | Mercado Pago: cuenta digital | 2.6M |

| 10 | iti: banco digital do Itaú | 2.4M |

| 11 | Crypto.com - Buy BTC, ETH | 2.2M |

| 12 | MetaMask - Buy, Send and Swap Crypto | 2.1M |

| 13 | СберБанк Онлайн — с Салютом | 1.9M |

| 14 | DANA - Indonesia's Digital Wallet | 1.9M |

| 15 | CoinDCX:Bitcoin Investment App | 1.8M |

| 16 | GCash - Buy Load, Pay Bills, Send Money | 1.8M |

| 17 | CAIXA | 1.7M |

| 18 | Navi: Loans & Health Insurance | 1.6M |

| 19 | Cash App | 1.6M |

| 20 | PicPay: Conta, Pix e Cartão | 1.6M |

| 21 | Binomo | 1.6M |

| 22 | Trust: Crypto & Bitcoin Wallet | 1.5M |

| 23 | Upstox Old - Stocks, MF & IPOs | 1.4M |

| 24 | CAIXA Tem | 1.4M |

| 25 | Claro Pay: Conta gratuita | 1.4M |

| 26 | Bajaj Finserv-Loan,UPI,Payment | 1.4M |

| 27 | Groww - Stocks, Demat, Mutual Fund, SIP | 1.4M |

| 28 | Huobi Global: Buy BTC & SHIB | 1.4M |

| 29 | Coinbase: Buy Bitcoin & Ether | 1.3M |

| 30 | Ame Digital: Carteira Digital | 1.3M |

| 31 | IQ Option – Online Investing Platform | 1.3M |

| 32 | neobank: BNC digital bank, tabungan online | 1.3M |

| 33 | Inter: Pix, Cartão e Conta | 1.3M |

| 34 | Serasa: Consulta CPF e Score | 1.2M |

| 35 | C6 Bank | 1.2M |

| 36 | bKash | 1.2M |

| 37 | bob World | 1.2M |

| 38 | Banco do Brasil | Conta, cartão, pix e mais! | 1.2M |

| 39 | KreditBee: Get Instant Loan | 1.1M |

| 40 | FGTS | 1.1M |

| 41 | Kotak - 811 & Mobile Banking | 1.1M |

| 42 | Wave - Mobile Money | 1.1M |

| 43 | OctaFX Trading App | 1.1M |

| 44 | Santander Brasil | 1.1M |

| 45 | ExpertOption - Mobile Trading | 1.1M |

| 46 | Yono Lite SBI - Mobile Banking | 1M |

| 47 | slice: Credit Card Challenger | 1M |

| 48 | BRImo BRI | 1M |

| 49 | Jar: Daily Savings in Digital Gold | 1M |

| 50 | Banco Bradesco | 1M |

Summary of Best Fintech Apps in 2021

To evaluate which are the best fintech apps during 2021, we can analyse their amount of app downloads or at the investor money the companies were able to attract. The sample of selected 14 European fintech app companies that achieved unicorn status in 2021 showed a 33% increase in year-on-year downloads. However, the correlation between the user demand and investment amount is not always significant.

The most downloaded apps in the finance category on Google Play in December 2021 were for mobile payments, challenger banks and crypto apps. The top also included Austrian unicorn cryptocurrency platform Bitpanda which showcased one of the fastest growth in the industry.

Of course reaching unicorn status is a nice achievement but it doesn’t ensure long term success. The pressure is now on these startups to maintain their growth and continue to scale internationally. Entering new markets with your app is one of the biggest challenges many businesses face. It requires paying close attention to marketing and optimisation. Neglecting or underinvesting in app store positioning can ultimately result in a failed market entry.

– Thomas Kriebernegg, MD of App Radar.

Latest Posts